Excise Taxes Concept Icon Legislated Taxation On Specific Goods Idea Thin Line Illustration Tax Levied On Commodities Services And Activities Vector Isolated Outline Drawing Editable Stroke Stock Illustration - Download Image Now -

Excise taxes concept icon. Legislated taxation on specific goods idea thin line illustration. Tax levied on commodities, services and activities. Vect Stock Vector Image & Art - Alamy

Excise taxes concept icon. Legislated taxation on specific goods idea thin line illustration. Tax levied on commodities, services and activities. Vect Stock Vector Image & Art - Alamy

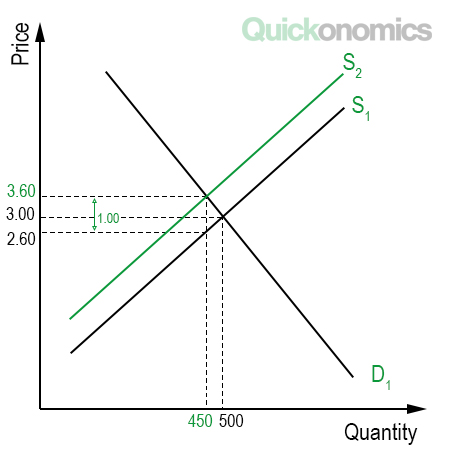

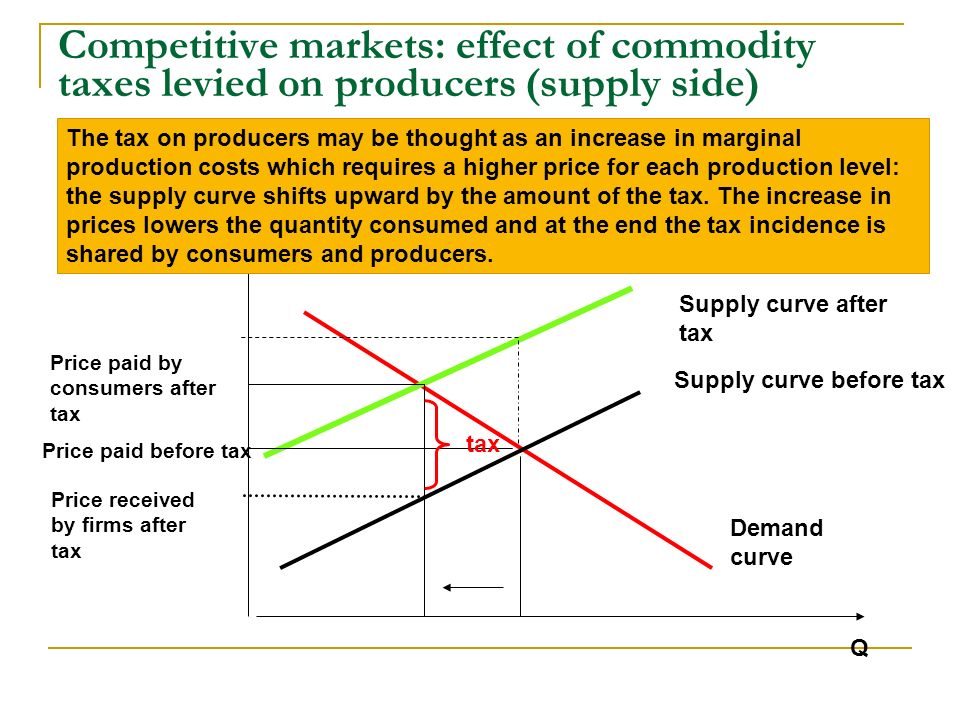

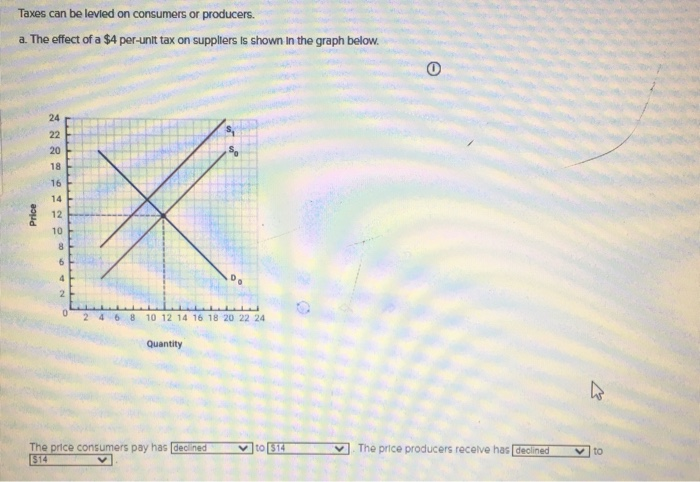

Using the mechanics of supply and demand, what does a tax do? How does it affect supply and demand and quantity in markets? | Homework.Study.com

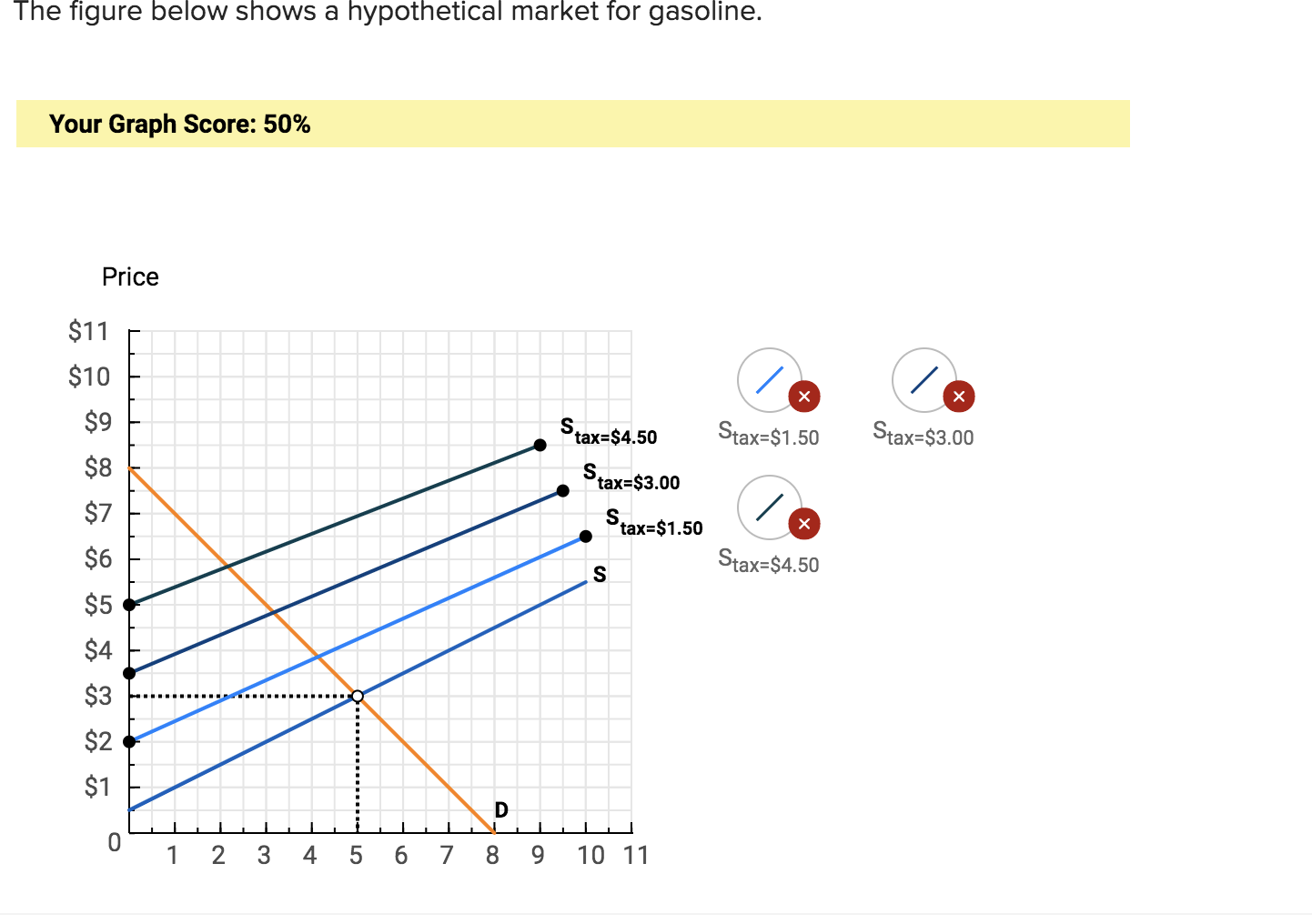

Question#7,8.docx - Question#7 Consider the market below. a. Suppose there is a $1.50 per unit tax levied on sellers. Draw the after-tax supply | Course Hero

Tax On Property Sale: TDS on property sale to be levied on higher of stamp duty value or sale amount: Budget 2022 - The Economic Times

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

:max_bytes(150000):strip_icc()/goodsandservicestax_final-1d03834f0ae14872b76dedbb72bf07fe.png)